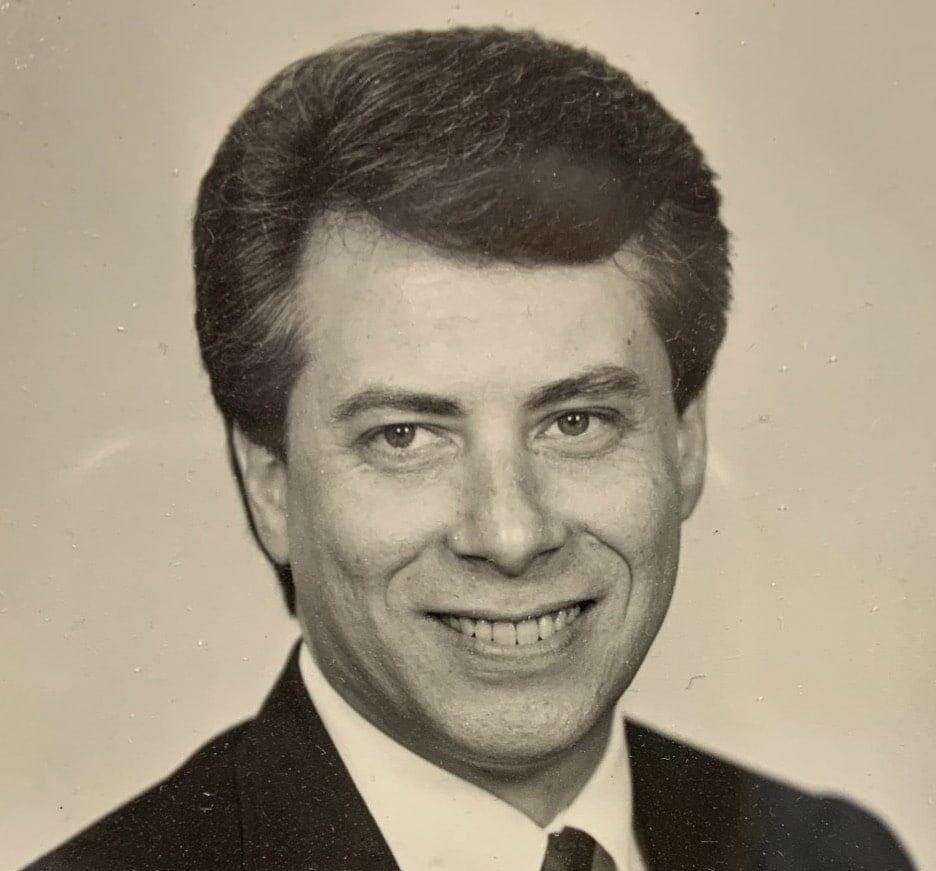

I recently had a conversation with Joel Forbess, President & CEO of Kimberly Clark Credit Union in Memphis, Tennessee. Joel is what I like to call, a staple. He is one of those distinguished fixtures in the industry that is not only well-respected and appreciated but there’s just something endearing about him. Joel’s career with the credit union industry began in 1982 as a teller at what is now First South Credit Union on the Navy Base. Referred by a friend who was working there at the time, little did he know that the simple act of that career change would span across decades. Joel originally began working for a small bank in Munford but after about a year he could tell it wasn’t going to take him very far. The bank didn’t offer much room for advancement and the general atmosphere wasn’t very promising for an eager young professional looking to find their place in life. Thinking back on those early years Joel recalled that the overall environment between the bank and the credit union was undeniably different. The staff at the credit union were warm and friendly and the industry as a whole offered a wide range of networking and development that seemed endless.

As he reminisced over his career I asked him what had been his favorite role throughout the years. Without pause, Joel said the loan department has been a favorite. It afforded him the ability to get to know members uniquely and intimately. Joel added, “It’s a rewarding feeling knowing they trust in you to achieve their goals and dreams.” Joel later joined Kimberly Clark Credit Union in 1985 and even served as Backup Computer Operator stating he liked that “you got to jump in and fulfill an important role. It was a hands-on, learning experience.”

I asked him to reflect on what he thought defined success. “Our leader, Janice [Welch], invested in the employees. We were provided learning opportunities, accessibility to professional development and they supported employees who wanted to learn and grow.” Joel went on to attend Southeast Credit Union Management School (SRCUS) in Georgia and graduated in 2005. “That experience changed everything. You’re in a group of like-minded people driven by the same passions for credit unions. It [the school] provides an intimate way of getting to know others in the industry through networking.” Comparing his time working at the bank and then later the credit union he stated “I knew I would be infinitely rewarded with opportunity at the credit union. There is so much learning available to those who want to put in the work. CUNA Management School is also a great opportunity available. Kimberly Clark Credit Union encourages the employees to consider attending. That was the greatest opportunity that I had. I felt it was the turning point for me and they [management] knew I was serious.” Joel added that now as a leader at KCCU “we’ve always encouraged our employees to get involved and continue learning. The League has always been a great resource for us to share with our employees so it is more than just a Monday through Friday, 9 to 5. It has been a great resource for us to take advantage of.”

It didn’t take more than 10 minutes into our conversation that I realized how alike Joel and I are. We have common interests, similar passions, we both love music and on occasion enjoy a tasty Almond Joy. What stuck out the most to me was that we both see a real return in investment when it comes to professional development. At some point in both of our careers, we have worked for organizations that invested in a structured learning & development plan as a benefit to their employees. I found myself imagining what life would have looked like for Joel had he not been awarded those development opportunities. What would my own life look like? As an organization, I invite you to think of a time when someone, somewhere took the time to invest in you as an employee. Develop you. Mentor you. Now imagine if that had never happened. How would the absence of that in your life change your trajectory? When you remove the professional development component from your career equation you lose the opportunity to not only increase employee engagement but you lose loyalty from your employees. If you never invest in the people then the people won’t invest in what you’ve tried to build. The absence of that investment charters an entirely different course for each member of your staff and it is felt within your membership. In research performed by Forbes, they found that 86% of employees that were polled said they “would change jobs if it meant more opportunities for professional development. Employers must understand that professionals are prioritizing their own marketability when making career decisions. Knowing that their employer is willing to provide them with learning opportunities will help employees see their value and encourage them to stay loyal to the organization.”

According to the 2021 LinkedIn Learning Workplace Learning Report, 64% of learning & development professionals agree that professional development shifted from “nice to have” to “need to have” in 2021. Whether you have 2 employees or 200 I urge you to take some time to reflect on what your learning & development looks like.

According to the 2021 LinkedIn Learning Workplace Learning Report, 64% of learning & development professionals agree that professional development shifted from “nice to have” to “need to have” in 2021. Whether you have 2 employees or 200 I urge you to take some time to reflect on what your learning & development looks like.

So who is Joel Forbess outside of work? What makes him tick? “Music has always been my first love. I was in the band in high school. Being a part of that group gave me an extra sense of pride. It gave me the early tools and structure that have carried on throughout my credit union career. It was a tight knit group and we encouraged each other.” Joel played both the clarinet and saxophone. His love of music has extended to not only his two sons, but also to a granddaughter who is a proud member of the coveted Munford High School Band. ” My wife and I were both in the band and we were high school sweethearts. We went separate ways for a bit then reconnected after high school.” Joel mentioned they both love to dance but he laughingly added that he and his wife Susan would both say he is the one with the rhythm. Although those band days are long over, he now lives vicariously through his family. His love of music has never changed and he has even challenged himself lately to learn the ukulele. Joel and Susan live in Munford, a small & rural community in Tipton County, roughly 30 miles north of Memphis. He loves spending time with his grandkids and proudly boasts he has a total of 8 grandchildren (6 girls 2 boys).

Lastly, I asked Joel “What did you want to be when you grew up?” He replied “After onboarding with a credit union I quickly knew that my goal was to be CEO one day. I had two great mentors in Sarah and Janice, along with the Board, that provided support and encouragement and I knew from early on that serving as a leader is exactly what I wanted to do.”