Meet Our GAC Crashers

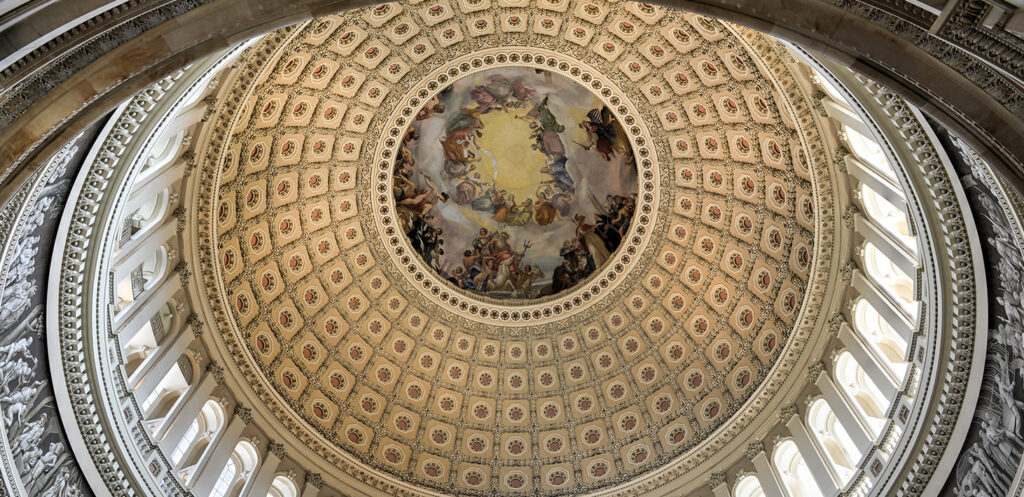

The Governmental Affairs Conference, March 1-5 in D.C., is quickly approaching. Among the attendees will be Tennessee GAC Crasher, Hannah Hutchins, marketing manager at Appalachian Community Federal Credit Union, and Mississippi GAC Crasher, Ruthie Murray, service specialist at Statewide Federal Credit Union. Young professionals have been Crashing the GAC since 2009. The program allows young […]

Tennessee Governor Give State of the State Addresses

Partial Shutdown Ends—Funding Restored to Community Development Financial Institutions for 2026 On Tuesday, President Trump signed a $1.2 trillion funding package into law ending a brief partial government shutdown that began early Saturday morning. The House voted 217-215, with support from 21 Democrats, following Senate passage last week. The bill provides funding for 95% of […]

January Advocacy Update

Looming Government Shutdown Federally, the week kicked off with a big advocacy win with Senator Marshall withdrawing his plans to offer the Credit Card Competition Act (CCCA) during the crypto bill mark-up in the Senate Agriculture Committee. While this is a win and a testament to America’s Credit Unions-League credit union system, we are still […]

Managing the 10% Credit Card Rate Cap Proposal

As Tennessee and Mississippi credit unions continue to serve as the bedrock of financial stability for our local communities, we are closely monitoring a significant shift in the federal landscape. President Trump has recently intensified his call for a nationwide 10% cap on credit card interest rates, moving the conversation from social media to the […]

Tennessee and Mississippi General Assemblies in Session and National Issues to Watch

Happy new year from your expanded Advocacy Team! With our first advocacy update of 2026, we’d like to start by officially welcoming our Mississippi colleagues and credit unions to the fold and look forward to advocating with and for everyone in this new era. And we’re off to a flying start. National Issues Impacting Credit […]

Treasury Department Issues Penny Rounding Guidance for Cash Transactions

More than a month after the U.S. Mint stopped printing pennies, there is now guidance on rounding for cash transactions. Shortly before Christmas, the Treasury Department issued the “Penny Production Cessation FAQs.” Rounding Guidance for Cash Transactions The Treasury Department shares that as pennies fall out of circulation, merchants will need to round transactions either […]

Tennessee Credit Unions Rally to Support Financial Literacy as Survey Results Highlight Urgent Need

A U.S. Chamber of Commerce survey, emphasizes the vital role of financial literacy in preparing individuals for the workforce. Key Findings from the Survey Addressing the Financial Literacy Gap in Tennessee Recognizing the widespread nature of the financial literacy issue, the Tennessee Financial Literacy Commission recently hosted three Financial Literacy Scorecard Summits. These Summits gathered […]

Credit Union-Backed Van Epps Wins Tennessee 7th District Special Election Tuesday Night

The votes have been cast, tallied and the people of the 7th Congressional District have spoken. Representative-elect Matt Van Epps defeated State Rep. Aftyn Behn Tuesday night to win a special election to serve the remainder of former Congressman Mark Green’s term. Van Epps won 53.9% of the vote with 96,988 ballots cast compared to […]

Longest U.S. Government Shutdown Ends

Last night, the U.S. House cast its final vote to approve the Senate-passed funding package to reopen the federal government. The measure passed 222–209, and President Donald Trump signed it. With this action, the nearly 43-day shutdown comes to an end, and a temporary path forward is now in place. Funding Implications The package includes […]

Government Shutdown Becomes Longest in U.S. History

This year’s federal government shutdown has officially become the longest one in American history, surpassing the previous record, which occurred over the winter holidays in 2018 into 2019. And for the first time since it started, there appears to be some life to reopening and further budget talks. Several political factors are at play here, […]