In celebration of International Credit Union Day on Thursday, Oct. 20, each week we will highlight what makes the credit union industry special.

Now, some of you have been in the credit union industry for a while. That’s the beauty in the credit union movement. Some professionals have dedicated their careers to member service for years — sometimes up to four decades! And some of you are newer to the industry, so this article is to help you better understand the amazing network you are a part of.

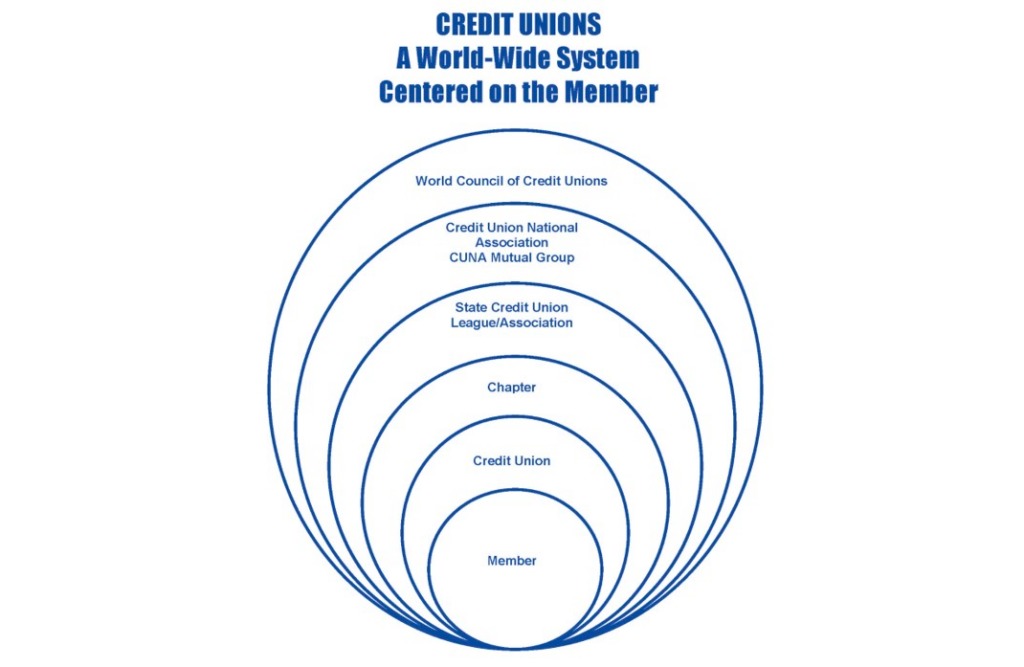

The Credit Union System

Think about an onion and its many layers. The credit union system is very similar. Here we’ll dive into those layers starting with the member and expanding globally to the World Council of Credit Unions.

Members

At the core of the credit union system is members. For without members, there wouldn’t be a credit union movement. Our members are the reason we exist! It is all about the credit union mission of people helping people.

Credit union membership is based upon a common bond. There are three main types of these bonds, also known as the credit union’s field of membership, based upon the Federal Credit Union Act of 1934.

Single Common Bond (occupational or associational) — A Single Common Bond federal credit union is chartered to serve one group sharing a common bond of either occupation or association. Within this designation, there are three potential charter types: single occupational common bond, Trade, Industry or Profession (TIP) bond and single associational common bond.

Multiple Common Bond (multiple groups) — A Multiple Common Bond federal credit union is chartered to serve more than one group, each of which share a distinct, definable single occupational and/or associational common bond, such as select employee groups and underserved areas.

Community — A Community Credit Union is chartered to serve members within specific, well-defined geographic boundaries where individuals have common interests and/or interact. Under this designation, there are two possibilities for building the field of membership. Once a community FOM is established, a credit union may serve all persons and businesses who live in, worship in, attend school in, or work within the specified area.

To Learn More About Credit Union Membership

If you are interested in learning more about field of membership, here’s the National Credit Union Administration Charter Guide. NCUA also has the MyCreditUnion.gov site, which is geared toward consumers (aka credit union members). Check out the “What is a Credit Union?” page for a fun illustration of the credit union difference.

Credit Unions

The layer builds with credit unions. Here in Tennessee, there are 134 member-owned credit unions. Some of the oldest credit unions in Tennessee are nearing 100 years old and seven credit unions are celebrating their 90th anniversary this year. We’ll celebrate those credit unions in an upcoming article.

To Learn More About Credit Unions

If you are interested in learning more about credit union locations, visit NCUA’s Credit Union Locator to find a credit union near you.

Chapters

The next layer is chapters, which are credit union professional development groups. The purpose of a chapter is to support the League, promote cooperation among credit unions, sponsor educational programs, and undertake other activities consistent with the proper credit union and community development. In Tennessee, we have seven chapters — Chattanooga, Hiwassee, Jackson, Knoxville, Memphis, Middle Tennessee and Northeast Chapters.

How to Get Involved

Most chapters have started hosting in-person meetings again. Meeting topics vary, but have included legislative forums, compliance training, fraud awareness, and networking activities like attending a local baseball game. To sign up for your chapter’s email group, please email events@yourleague.org.

Leagues

The fourth layer is the state credit union league or association. In Tennessee, its us — the Tennessee Credit Union League. We are the trade association for the state’s 134 credit unions, more than 6,300 credit union employees and more than 2.5 million members. We’ve been helping promote and support the success and advancement of Tennessee credit unions since 1934! And we are honored to serve you, your credit union and your members.

How to Get Involved

Be sure to follow the League on Facebook, Instagram, Twitter and LinkedIn. While you receive the League newsletter, encourage others at your credit union to subscribe to League communications by emailing hello@yourleague.org.

CUNA and CUNA Mutual Group

The fifth layer is the Credit Union National Association and CUNA Mutual Group.

CUNA

CUNA is the most influential financial services trade association and the only national association that advocates on behalf of all of America’s credit unions. They work tirelessly to protect your best interests in Washington and all 50 states to help credit unions better serve the nation’s 130 million members.

CUNA Mutual Group

CUNA Mutual Group was founded more than 85 years ago by credit union leaders who were looking for an insurance and investment partner they could trust. For generations, CUNA Mutual Group has helped credit unions, businesses and hardworking Americans build financial security. In May, CUNA Mutual Group announced it will unify its business under a single brand, TruStage, in 2023.

How to Get Involved

Be sure to create a CUNA profile and sign up for CUNA news under “Communications Preferences.” A favorite is “The Nussle Report” by Jim Nussle, president and CEO of CUNA, that is sent on Fridays with a recap of the week.

World Council of Credit Unions

The World Council engages in advocacy, development and education to champion and grow credit unions and cooperative finance worldwide. Did you know? There are 86,000 credit unions in 118 countries that are improving the lives and communities of 375 million members. The organization is headquartered in Madison, Wis.

How to Get Involved

To subscribe to the World Council of Credit Unions’ communications, please click here.